Executive Summary

- Alphageo India Ltd (Alphageo) is a play on the humongous seismic survey opportunities that are getting unfolded in the Indian subcontinent.

- After 2 decades of inactivity, the Directorate General of Hydrocarbons (DGH) in India, has floated a project titled “seismic data acquisition in unappraised onland areas of Indian Sedimentary Basins” amounting to a total contract value of more than Rs.30 billion; this is by far the largest seismic contracts floated by the government, through ONGC and OIL, in India.

- Alphageo has bided for all these contracts, and has already won the first contract from ONGC amounting to Rs.2,424 Mn. For the other contracts, the company has already qualified the technical bid and is awaiting the price bids to be finalized.

- The company is in a sweet spot as it is the only India player that is both technically and financially capable to leverage on these opportunities. The level of competition has significantly eased, as all the other players are already straddled with debt and making operating losses. Competition from international players is relatively low as their focus is predominantly on seismic surveys in off-shore and deep water reserves rather than onshore reserves, where Alphageo is the largest player.

- The current unexecuted order book of Rs.2,620 Mn, which has to be executed over the next 24 months, already adds up to the last 5-years revenues. Likewise, if the company is able to bag even 10% of bided projects (which would be awarded in the next 6 months), the business opportunity would add up to last 10-years of revenues. Alphageo is hence all geared to transition into a different league, 5-years down the line.

- Other opportunities that are not factored in are – auctioning of NELP-X and the marginal fields of ONGC and OIL, which are likely to take place in the next 6-9 months. Plus, should the trend in oil price reverse, pickup in exploration activity in Mynmar and Africa, where the company already has some presence, will further support the growth in business.

A Quick Take on the Company

Incorporated in 1987 and based in Hyderabad, Alphageo is engaged in acquiring, processing, and interpreting two dimensional (2D) and three dimensional (3D) seismic data for exploration companies in the oil and gas sector in India and internationally.

Over the past 25 years Alphangeo has a track record of carrying out 15,000 km of 2D projects and 5,000 sq. km of 3D projects spread across 49 projects. The company is India’s leading on-land integrated private sector seismic services player.

Level of Seismic Survey Activity in India is at its Peak, Despite Falling Crude Oil Prices ~ after 2 decades of inactivity the DGH in India, has floated a project titled “seismic data acquisition in unappraised onland areas of Indian Sedimentary Basins” amounting to a total contract value of more than Rs.30 billion; this is by far the largest seismic contracts floated by the government

- For about two decades, no fresh assessment was done to gauge the hydrocarbon potential of all the 26 basins of India.

- Thanks to Mr. Talukdar, who after taking charge of DGH in 2014, initiated scrutiny to know the extent of unapprised area in the country. This was found to be around 50%. Steps were then taken with the approval of the ministry to cover all onshore areas by a 2D seismic survey within an upper limit of five years, under the project titled “seismic data acquisition in unappraised onland areas of Indian Sedimentary Basins”.

- The mandate for this was given to ONGC and OIL, who have already floated tenders and are in the process of awarding these contracts.

- Alphageo has bided for all these contracts, and has already won the first contract from ONGC. For the other 2 contracts, the company has already qualified the technical bid and is awaiting the price bids to be finalized.

In this Scenario, Alphageo is in a Sweet Spot as it is the Only Indian Player with Both Technical & Financial Capabilities to Grab these Opportunities ~ level of competition has significantly reduced as all the other players are straddled with debt; International players largely focus on seismic surveys in off-shore and deep water reserves rather than onshore reserves

- Seismic survey is highly knowledge and capital intensive. Given the nature of work, technical capabilities, right technologies and equipment, prior experience with similar topography, and timely execution of projects act as entry barriers.

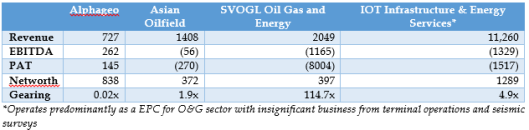

- Companies need to regularly make investments in acquiring technologies and equipment. For instance, Alphageo has invested ~Rs.400 million over the past 2 years in order to gear up for the opportunities unfolding in the sector. The same levels of financial flexibility is very limited with other players as reflected in the table below.

- This has reduced the level of competition to a great extent. For instance, according to Petrowatch, only 4 companies bid for the contract floated by OIL for 2D seismic data across NE India.

- Likewise, the contract floated by ONGC for 2D seismic data across 22 sedimentary basins in India, is split across multiple packages and the level of competition within each package is expected to be low.

- International players that also compete in the Indian subcontinent include CGG Veritas Ltd, WesternGeco Ltd and Petroleum Geo-Services ASA. However, most of these international players largely focus on off-shore and deep water reserves rather than onshore reserves.

Hence, Alphageo is Well Placed to Transition into a Different League 5-years Down the Line…

- 2-year revenue visibility already adds up to 5 years of business opportunity, and these includes only the confirmed and unexecuted order book as on September 30, 2015

- 5-year revenue visibility adds up to 10-years of business opportunity, assuming the company is able to bag only 10% of the total bided projects.

Other Opportunities ~ NELP-X auctions that are expected to take place in FY17 & Auctioning of 69 marginal fields by ONGC and OIL in Q4-FY16

- NELP-10 wherein the Government will offer 42 oil blocks to successful bidders, creating business opportunities across 18-24 months.

- The consultation papers floated recently talking about moving towards new Open Acreage Licensing Policy, replacing opaque production sharing contracts with much simpler revenue-sharing regime for all future field auctions, along with a Uniform Licensing Policy.

- The government is also auctioning 69 of the 165 marginal fields (86 onshore and 79 offshore) owned by ONGC and OIL, because at current prices, it is not commercially viable for the PSU oil companies to produce from these fields. Smaller technology and equipment companies are expected to bid for these blocks with 89 MT of oil and gas reserves. The plans once realized will not only improve the balance sheets of ONGC and OIL, but will also improve the reserves of the country.

- In October, to test the waters, the NDA government allowed pricing freedom for the gas produced from 69 small and marginal fields it plans to auction shortly, and are testing how market behaves. The auctions are planned to take place in Q4-FY16

- In addition to these opportunities, once the oil price trend reverses, new exploration projects both in India and overseas will bring in new opportunities. The company already has presence in Myanmar where it just started executing a $3 Mn contract that would be completed by the end of FY16. It is also making inroads in Africa so as to place itself when the exploration activity picks up.

Financial Summary:

Other Updates:

- The shareholders of the company at the Extra-Ordinary General Meeting on 11 November 2015, have approved the issue of 8,30,000 warrants to Promoters and Promoter group on preferential basis at a price of Rs 513.62ps per warrant, each convertible into one equity share of Rs 10 each at a premium of Rs 503.62 per share.

- Increase in promoter holding –

- In the quarter ended December 2014, promoter shareholding increased from 41.59% to 41.73%.

- In the quarter ended September 2015, promoter shareholding increased from 41.73% to 41.98%.

What is the delay in new orders?

LikeLike

Well, its unfortunate that Quippo has contested ONGC’s and OIL’s tendering process because of which all the seismic tenders have been put on hold. The issue is sub-judice.

Nevertheless, small orders continue to flow in and the company is well occupied for the next 18 months.

LikeLike

seems like the bids are opened. Target 1200/-?

LikeLike

Lets not comment on the target, but yes even I am told that the case is cleared and close to 4000 cr. of bids are expected to be opened. Yet to confirm this from legitimate sources.

LikeLiked by 1 person

Lets wait for the orders to flow in.

LikeLike

hi.. thanks for the info. Couple of qns: (1) If there are 30 bn worth orders on the offing and Alphageo is the only major player taking less than 15% order – their balance sheet also may not support more than that in short term – who is the other competition? (2) Many players in this same field have failed before? What is the main reason? How was Alphageo able to sustain when others died?

LikeLiked by 1 person

This is a capital intensive business, and hence one needs to balance between growth, leverage, and the visibility on asset turnover. If you look at Alphageo’s 10-year history, its peak leverage was 1.4x that too way back in FY06, plus its asset turns have remained healthy between 1.2x-1.5x for most of this period. However, incase of competition this wasn’t the case and hence most of them are now straddled with debt and are finding it difficult to service. Please refer to the post on the competitors.

Whether Alphageo can cater to such large orders, the company has already invested Rs. 400 million over the last 2 years, which can well execute the current orders in hand. Further, the company recently got the shareholder approval to raise its debt limit. That should indicate the preparedness of the company.

LikeLike

with the contract sizes being large there could be cut in ebita margins. Should we consider it to be in range of 15-20%???

LikeLiked by 1 person

Pingback: Update: Alphageo India Ltd – Q3-FY16 Results | Ideas with Conviction

Significant contraction in margin is possible only if there is intense competition. I don’t think that is the case, given the financial position of the other players.

LikeLiked by 1 person

On the contrary if others might be even more desperate to get orders to service debt, they will undercut severely. If they are sitting on unused capacity (assuming they expanded rapidly by taking all the debt) then aren’t they better placed? Their PAT will increase more rapidly with deleveraging (reduction of interest outflow). If there is such a huge cyclical turn in the industry the best investment maybe on the worst company in terms of debt.

LikeLike

Please refer to the recent post. The standalone revenues in Q4-FY16 is largely from the execution of the Rs.245 cr. ONGC order. Now if you look back at the history of this order, for some reason there was a re-tendering that took place and hence Alphageo had to rebid for the same work at lower price. The standalone margin of 27% in Q4-FY16, should be reflective of the profitability of the overall contract. While I wouldn’t be surprised if the margin at the end of the project lands at 22-24%, given the size of these contract this should still not dilute the company’s return profile.

Please share your thoughts on Asian Oilfield or SVOGL, incase you find them to be interesting.

LikeLike

Nicely written article. as you have mentioned that they have asset turnover ratio of 1.4-1.5. Now they have received very big order of Rs.1492 crs from ONGC, how they are going to fund this execution. as if you consider a average turnover of Rs.500 crs a year, they will need asset of atleast Rs.300 crs to execute it. How they are going to fund that asset? Any idea.

LikeLike

Yes, your are right. Assuming fixed asset turns of 1.7-1.8x and incremental execution of Rs.500 cr. per year for the new orders, the capex needed should be anywhere between Rs.250-300 cr. The company is currently debt free with a net worth of close to Rs.110 cr. So they have the option to raise debt, an approval for which was already taken in December 2015. However, given their past track record it is unlikely that the company would look at leveraging itself beyond 1x. So I wouldn’t be surprised if they look at raising some equity as well. Lets wait for an update on this.

LikeLike

Hi – even after a big order Alphageo has not been able to get a strong institutional investor/ DII. Also the latest June shareholding shows share distribution. Would you look into these factors?

LikeLike