Anubhav SahuMoneycontrol research

Bodal Chemicals, a leading manufacturer of dyes intermediates and dyestuff products in India, looks set for a strong growth trajectory on the back of a number of tailwinds.

Over the years, it has played its cards right. Its capacity expansion plans, vertical integration and foray into specialty chemicals have been undertaken by the company with an eye on future prospects. Further, slowing of imports from China should help in garnering higher market share whereas an increasing presence in downstream value chain should boost margins.

Bodal exists in a largely unorganised sector taking up about 50 percent of the market share. It should also benefit from the expected shift towards organised sector in the post GST era.

Dye Manufacturing Value Chain

Company Brief

Bodal is a fully integrated manufacturer of dyestuff having a presence across the whole value chain from basic chemicals (~45 percent consumed captivity), intermediates (40 percent consumed captivity) and dyestuff. It holds a market share of 10 percent in dyes and 20 percent in dyestuff in Indian market. The company exports (29 percent of FY17 revenue) its products to 45 countries with major contribution from S Korea (30 percent) and China (17 percent). The products find use in diverse industries such as textile, paper, plastic, leather etc.

Downstream Capacity Expansion

The company’s current capacity for dyes and dye intermediates stands at 17000 MT and 30,000 MT, respectively. As part of its huge capacity expansion plans, it envisages dyes manufacturing capacity to increase to 41000 MT in the next 4.5 years. The first phase of 8000 MT capacity is expected to go on stream by Q4 2018.

In the dyes intermediates space (H-Acid and Vinyl Sulphone), it recently acquired 70 percent stake in SPS Processors with a capacity of 3000 MT. Environment clearance, a crucial factor in this sector, is already in place. Bodal plans to expand capacity by 4200 MTPA by Q2FY18. With these plans, it would use 90 percent (currently 40 percent) of the dyes intermediates for captive consumption in the next 2-3 years, which will help it improve its margins.

New Products and Diversification

Its stake holding in Trion Chemicals, which is a joint venture with Raj Chemicals, will give it access to specialty chemicals business.

Trion has a 12000 MT capacity for Trichloro-isocyanuric acid (used for water purification and in textile industry) and it mainly caters to the US market.

Bodal has recently introduced products like liquid dyestuff (capacity 10800 MT) and LABSA (capacity: 18000 MT) used in paper industry and detergent application, respectively. New export-oriented products like Trichloro-isocyanuric acid and liquid dyestuff, not only helps in diversification but also aid in generating higher margins due to low competitive intensity.

China Opportunity

The dyes and pigments sector in the last few years have benefitted hugely from the China opportunity as increased compliance norms there had led to the closure of various chemical manufacturing facilities in China. Of late, some of those facilities in China have made a comeback like Hubei Chuyuan – one of the biggest integrated dyestuff manufacturers, but it is operating at a low capacity utilization.

The relative cost dynamics, nevertheless has shifted in favour of India. Says Mayur Padhya, CFO of Bodal Chemicals, “We learnt that environmental compliance cost in terms of setting up effluent treatment plant (CETP) constitute a huge cost (20 percent of total cost). This means that the cost arbitrage Chinese manufacturers were enjoying due to non-compliance would be lost. Additionally, China manufacturers no longer enjoy a huge export incentive like they did in early 2000. Similarly, labour cost arbitrage is also lost. In fact, for the dyes and pigments industry, some of the Indian manufacturers highlighted that wage cost in some cases for Chinese manufacturers is now 2.5x that of India.”

Going by this, opportunity coming in due to China vacating the market appears more structural in nature and organised players in India, like Bodal, which has an established capacity and environmental compliance track record, can meet the demand requirement.

Improving Leverage Profile Positions

The company has benefitted from strong operating performance in the last few years that helped in generating healthy cash flow and reduce debt. Its net debt to equity ratio reduced to 0.38x in FY17 from 1.1x in FY15. As per management, capex required for the first phase of dyestuff manufacturing (8000 MT) is to be funded by internal accruals. The company’s additional plans like capacity expansion for Trion and LABSA (~ Rs 25 crore vs total debt of Rs 151 crore) may partially require debt funding which should not be a concern given the moderate leverage ratio.

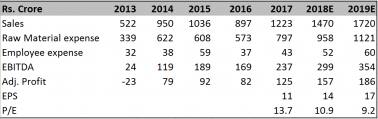

Financial Snapshot

Financial Projections and Recommendation

Given the company’s recent foray into specialty chemicals (Trion JV), the introduction of LABSA & liquid dyestuff and the stated expansion plans, we expect the growth momentum to continue with sales CAGR of 19 percent (FY07-19E). Bodal is expected to be relatively immune to the volatility in raw material prices due to vertical integration (raw materials approximately constitute 65 percent of sales). We estimate improved earnings (20.6 percent EBITDA margin FY19E vs 19.4 percent in FY17) on account of increasing share of higher margin products.

Currently, Bodal trades at 9.2x 2019E earnings which appears attractive. In terms of trailing P/E (14x), Bodal is at a discount to the peer average of about 17x. Recent correction in stock (of about 7 percent from its high), in our opinion provides a decent price level for a multi-year investment horizon.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!