Madhuchanda DeyMoneycontrol Research

AU Small Finance Bank had a stellar debut on the bourses last year with a listing gain of close to 47 percent. Since then the stock has risen close to 22 percent, putting it in the modest performer category. If one tracks the last five quarters of its existence as a bank and its execution so far, the performance leaves no room for disappointment. Key pillars of the bank - strong asset growth with adequate diversification, control over delinquency, building a stable deposit base and numerous tie-ups to ensure healthy fee traction - have all been falling in place.

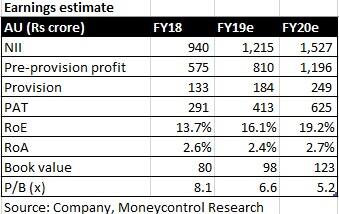

The Indian banking system is undergoing a tectonic shift with a significant growth opportunity arising from the near demise of a large number of state-run banks. Smaller entities, with the right strategy and execution, will therefore see a clear road ahead. Founded by a first generation entrepreneur with a successful track record, AU has the right ingredients to succeed in the current milieu. The recent capital infusion by Temasek reinforces this confidence. While the stock looks optically expensive, investors should focus on its strong earnings growth trajectory. We estimate a 46 percent compounded annual growth rate in earnings in the next two years. The stock price should ideally mimic the same.

While small finance banks have to maintain 25 percent of their branches in unbanked areas, 50 percent of loans below the ticket size of Rs 25 lakh and 75 percent of their book as priority sector lending (PSL), AU has been complying with the same and growing as the market potential is significant and not everyone has the domain expertise that AU has built in its non-banking finance company avatar.

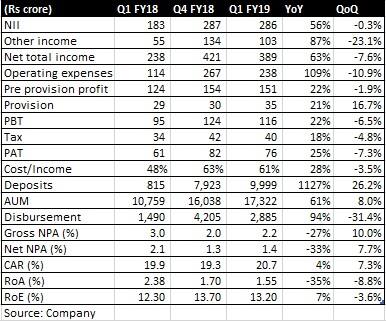

Quarter at a glanceIn the quarter gone by, AU reported modest headline performance while showing a significant improvement in multiple parameters.

It is relevant to note that growth in net interest income (the difference between interest income and expenses) lagged the growth in assets under management as net interest margin (NIM) moderated. This was especially stark on a quarter-on-quarter basis, as the bank saw a very high disbursement at relatively lower incremental yield in the previous quarter. The management attributed excess liquidity in the balance sheet for NIM compression as well.

It is pertinent to note that while incremental lending yield is lower than blended, therefore signalling that yields are trending down, it is, however, compensated by lower incremental cost of funds. As a large part of the liability gets converted to deposits from borrowings, the bank expects its interest margin to improve to 6 percent from 5.5 percent at present. In the past one year, it added over Rs 7,000 crore in deposits (excluding certificate of deposits). Of this, over half has been from granular retail. As increasing proportion of incremental advances get financed by deposits, the pressure on margin should gradually wane.

Non-interest income has been growing on the back of selling priority sector lending certificates (PSLC) as AU continues to generate excess PSL. Distribution tie-ups for third-party products has also started contributing. The company has also been empanelled with Life Insurance Corporation (LIC) for the branch banking business.

Cost-to-income ratio continues to remain high as AU had up-fronted costs due to conversion to the bank. This should moderate as it sweats these new distribution.

Asset quality is healthy and so is its capital position. The bank has recently raised Rs 1,000 crore from Temasek. Of this, Rs 425 crore has already been infused and the balance would take place in December next year on conversion of warrants. So, the bank may not need capital in the next two years despite aggressive growth targets.

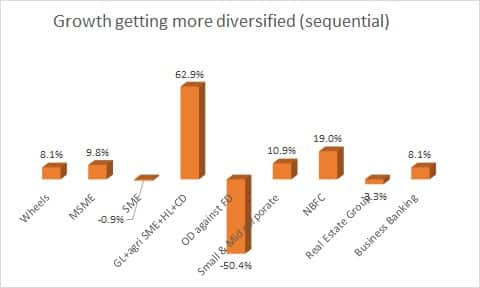

De-risking growthGrowth has been strong and getting broad based. While retail continues to show healthy growth on the back of older products like wheels, small and medium enterprises (SME) and MSME, new products like gold and agri SME are also gaining. The relatively new small and mid-corporate segment has been showing strong gains on the back of traction seen in NBFC lending and business banking. While this diversification stands to compress lending yields, its impact on margin depends on the steady and fast build-up of its deposit base.

Source: Company

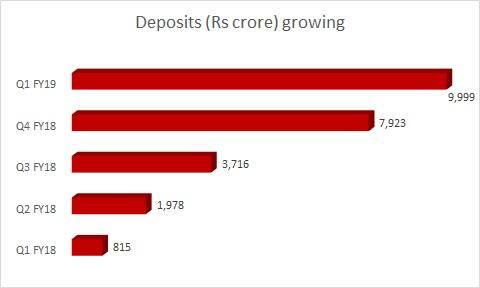

Deposits key to margin improvementThe bank has been growing its deposit base very aggressively ever since its conversion from an NBFC five quarters back. The share of deposits in overall borrowings has touched 59 percent from 9 percent in the year-ago quarter. Consequently, its cost of funds declined to 7.9 percent from 9 percent in the year-ago quarter, with incremental cost of funds in Q1 FY19 at 7.25 percent. Improvement in share of deposits, especially low cost current and savings account which now stands at 28 percent, is pivotal in improving margin.

Source: Company

The bank so far has maintained a very respectable asset quality and doesn’t see much risk in its addressable market. It plans to accelerate growth going forward as the key pillars of the bank are well established. We would like to monitor this closely as small entrepreneurs have shouldered the burden of demonetisation as well as Goods & Service Tax in recent times.

The dynamic management alluded to their long term track record in lending to small ticket borrowers. We believe that experience should stand them in good stead. We see strong earnings acceleration going forward and do not see much of a risk to the premium multiple. AU Small Finance Bank appears to have all the correct ingredients to stand out in the competitive market and should form part of the long term portfolio of investors.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!