Cash is king and for internet companies, it is often the lifeline that keeps them alive. So when you think of internet companies, you think of them as cash guzzlers that often use huge chunks of investor capital to gain scale and market share. An antithesis of all that we perceive internet companies to be is Noida-based Info Edge, the first internet company to be listed in India. Info Edge is the country’s leading online classifieds company with a leadership position in recruitment, real estate and a growing presence in matrimony and education. What makes Info Edge stand apart from other pure-play internet peers is the fact that its flagship business Naukri, which is the undisputed leader in the online recruitment space with a 73% traffic share, is a cash-generating machine which spews more than Rs.4 billion from operations. In fact, cash generation from the business has been rising steadily over the past couple of years thanks to high margins. Naukri, which brings in 70% of the revenue, has seen EBITDA margin improve from 51% to 56% over the past five years.

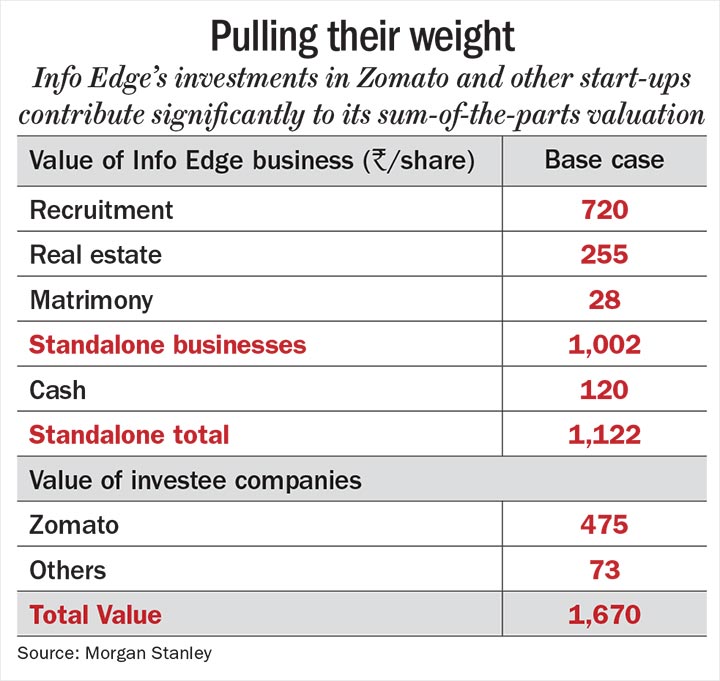

Until FY11, the business was generating upto Rs.1 billion, which doubled to Rs.2 billion by FY15 and now by FY18, the cash generation has doubled again to Rs.4 billion. This not only allows the management to invest more in the other three verticals — real estate, matrimony and education — but also pursue investment opportunities outside the company. Over the 10 years led by Sanjeev Bikhchandani, its founder, Info Edge has built a solid portfolio of investments in more than 15 start-ups such as Zomato and Policybazaar (see: Pulling their weight). A leadership position in their flagship business, prudent capital allocation and a smart investment strategy meant the company was able to generate a compounded return of 32% for its shareholders over the past five years.

Breaking into new verticals

Launched in 1997, Naukri broke even within two years of its operations, attracting its first investment from ICICI Venture in 2000. The company turned profitable in 2002. With the company generating cash, the option was to take Naukri international or look at other avenues of growth within the classified business. “We decided to stay with the market and consumers we understood as opposed to taking the company global. Online is a winner-takes-all market. So if there was a strong incumbent in the geography we wanted to foray into, no matter how good Naukri was, it would have been difficult to win, just like Monster struggled in India. The large markets already had strong incumbents and for markets with no large local players, it didn’t make economic sense to have a presence there. So we decided to focus on India,” says Bikhchandani.

As a first step, the company bought back the 55% stake it sold in Jeevansathi in 2004 to fully own the matrimonial match-making site. Jeevansathi was initially part of Info Edge but since ICICI Venture wanted to solely invest in Naukri, Jeevansathi was hived off. Now that they were exploring newer verticals, the company decided to buy back the stake. In the next one year, it launched 99acres, a property-listing portal to add its portfolio offering. “We were taking revenue from print since the advertisers were shifting online. We felt that if we could do this for jobs, we could also do this for other categories such as matrimony and real estate. What we didn’t realise is they were very different. We had the confidence of ignorance. You know how all babies look the same but grow up with different personalities. It was something like that,” says Hitesh Oberoi, CEO, Info Edge.

In 2006, Info Edge went public in a bid to provide an exit to its investors. The company also started to invest in start-ups that caught Bikhchandani’s attention. “The business was generating enough cash. We could either return it to the shareholders or do something with it. We looked at acquisitions but companies even half their worth were too expensive. So we decided to back promising entrepreneurs. We usually prefer to go in early since having done it ourselves, we understand the early stage better than other investors,” says Bikhchandani, who leads the company’s investments while Oberoi drives the execution of all its businesses.

Policybazaar was the second investment that the company made in 2008. Yashish Dahiya, the co-founder and CEO of Policybazaar was a classmate of Oberoi and told him how the online insurance space had scaled up in the UK and that there was an opportunity to replicate the model in India. “We invested about Rs.200 million for a 49% stake on a PowerPoint. If we were too logical about our investment, maybe we would not have invested so much based on just a presentation. But he had worked in a similar company in London and knew the space rather well. He even demonstrated how I paid 60% more on my car insurance because I hadn’t compared all the offerings and that convinced us more,” says Bikhchandani. Dahiya feels both Bikhchandani and Oberoi gave them a lot of confidence — backing their decisions completely and acting as a sounding board whenever required. “Bikhchandani has always asked me to focus on people and values. He would say that if you have a good employee who is no longer a great performer, find them a different role because the person has given the best years to the organisation. As long as you can afford it, do it. But at the same time, if you find somebody behaving unethically, however good a performer they may be, cut your bonds as early as possible,” he says. Bikhchandani was also a stickler for cash: “He always put cash ahead of revenue and premiums. We were revenue and profit-centric but since we dealt with large insurance companies, their payments were lumpy. He wasn’t too comfortable with massive swings in cash position and would ask us to keepan eye on cash flows.”

Info Edge has invested nearly $46 million till date in Policybazaar (including the latest fundraise where it co-invested with SoftBank in a $200-million round) for a 13% stake. Policybazaar is now valued at around $1 billion and Info Edge has already doubled its investment. In 2008, the company also ventured into the education space through the launch of Shiksha. “We want to be the TripAdvisor of education where we help students choose the college and courses they can pursue. Apart from the top universities, there is very little information on private colleges and universities. So we are building a lot of content to help students make better choices. We are also getting the alumni of various colleges from our Naukri database to vouch for their institutions, which can be a great value-add for the students. The education vertical managed to make some profit last year. It is still early days but the opportunities are exciting,” says Oberoi.

The fountainhead

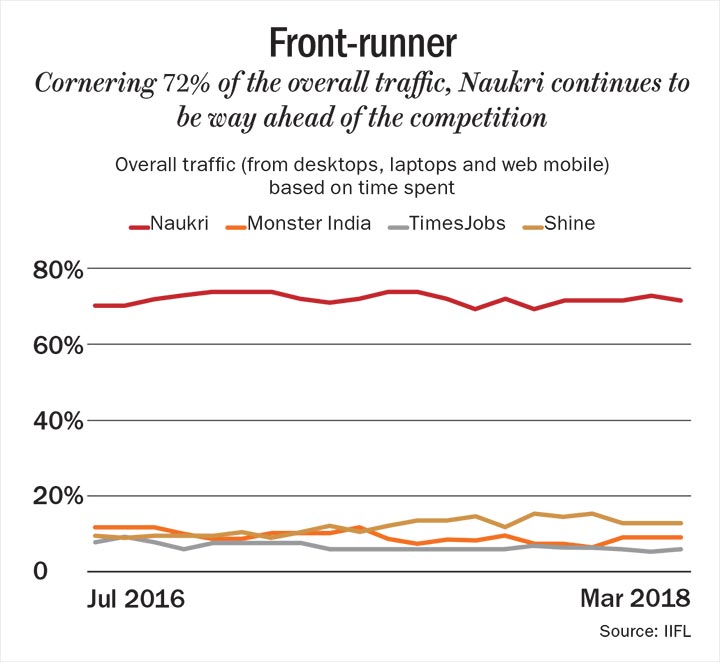

Even as the other verticals are taking their time to scale, Naukri has seen steady growth with little competition to talk of (see: Front-runner). Naukri, which boasts of 76,000 clients, 47,500 job listings on a given day and 57 million resumes, has seen its margin improve from 30% to 55% over the past 10 years driven by 40% increase in pricing thanks to its strong leadership position.

“Naukri’s revenue grows in line with India’s GDP, but with a multiplier effect. There is a common perception that Naukri’s revenue growth would be directly linked to the hiring growth in India. However, in our view, attrition is a key revenue driver for Naukri because an increase in attrition leads to more business for the portal,” says Rishi Jhunjhunwala, vice-president, IIFL. He points out that Naukri’s revenue grew at a CAGR of 16% over the past four years as IT services saw high attrition and the captive arms of global MNCs witnessed high growth. About 45% of Naukri’s revenue comes from IT and ITeS through direct recruitments and hiring firms. Apart from offering its clients a complete recruitment management system, which consolidates all online and offline recruitment processes and puts all resumes received under one database, Info Edge is now investing in machine learning and artificial intelligence to come up with better matches for recruiters and job seekers. According to analysts estimates, Naukri, which currently brings in Rs.7.08 billion as revenue is likely to grow by 18-19% over the next five years, ensuring that the Info Edge engine chugs along nicely. Apart from its traditional competitors such as Monster India, Shine and TimesJobs, the social platform LinkedIn, where users connect with recruiters, is also seen as potential competition for Naukri. But IIFL’s Jhunjhunwala says since there is a difference in the business model and target market, Naukri may not have too much to worry. “LinkedIn is dependent on mid-to-high management profiles through social networking whereas Naukri’s target customers are companies that require bulk hiring at mid-to-low management levels. However, staffing companies could possibly be a competitor for Naukri in the long term, although those are mostly focused on general staffing currently,” he says. But Ashish Gupta, senior managing director, Helion Venture Partners, who also sits on the board of Info Edge, has a different view: “LinkedIn has to be taken seriously and it is being taken seriously. The opportunity for Info Edge in the employment services space is to take what they know and develop new products to compete with the likes of LinkedIn,” he says. The company is also looking to crack the blue-collar segment, which it believes could be a big opportunity in the next 10 years and has made an investment in a company called Unnati to tap into the segment.

Realty check

While Naukri moves from strength to strength, Info Edge’s real estate vertical is seeing a comeback of sorts. 99acres, which controls 51% of the overall traffic share and makes up 15% of Info Edge’s revenue, is recovering from the slump it was seeing as transactional volume hit an all-time low in the real estate market thanks to demonetisation, GST and regulatory changes brought about by RERA. Unlike other online real estate start-ups who splurged their investor cash on marketing campaigns, Info Edge decided to focus on improving the product and data quality on the site since the real estate market is opaque. It had raised $125 million through a QIP in 2014. The financial prudence held them in good stead when the market collapsed. While many of its competitors fell by the wayside, 99acres used the downturn to consolidate its position. While no doubt its revenue growth did take a hit over the past couple of years, the company was able to bounce back with stronger growth when the market recovered. “We don’t look at competition but look at our customers and their needs. If the competition is doing something that impacts customers, then we need to be worried but if they are just doing things to gain market share and eyeballs, thereby driving up their valuation, then we don’t respond. Today most companies use capital to destroy value rather than create value,” says Chintan Thakkar, CFO, Info Edge. He points out that despite the marketing blitzkrieg by its counterparts over the past couple of years, Info Edge has spent a total of $35 million over the past 10 years. With its war chest of $125 million still intact and the real estate market starting to recover, analysts expect the real estate vertical to record a revenue growth of about 34-35% over the next five years as they expect online penetration to increase from 15% to 30%. According to the company, real estate is one of the biggest spenders in print and much of it will eventually move online. Advertising on real estate portals has already touched Rs.3.5 billion-4 billion in FY18. “There is a lot of emphasis on 99acres. While the online real estate space has not done well in the country, it forms a large part of the classified business and hence presents a continued opportunity for the company,” says Gupta.

Hits and duds

Info Edge’s other two verticals Jeevansathi and Shiksha together contribute 15% revenue and they are not large enough to move the needle or make an overall impact on the business. Jeevansathi, which is the third largest player after Matrimony and Shaadi, has a 10% revenue share of the overall market and over the past two years has seen a 20% volume growth YoY as it resorted to aggressive pricing. While it will continue to focus on its stronghold market — North India — analysts expect the vertical to grow at 20% over the next five years as online penetration, which is currently at 10%, increases. As far as education goes, the company is also making investments in start-ups to increase its overall share. For instance, it has invested in a company called Univariety, which helps schools provide career and college guidance to their students, and Meritnation, which is into e-learning. According to Vivekanand Subburaman of Ambit Capital, apart from the cash generated, the experience from the two downturns (2002-03 and 2008-09) has led the company to build a portfolio of internet businesses instead of managing a single business. “The strategy was to create a portfolio of businesses with different gestation periods, risk points and inflection points so the returns from successful ones make up for any failures,” he says. That strategy has played out quite well for the company. While it had to provision for some of its dud investments such as Canvera, Studyplaces and Ninety Nine Labels (a total of Rs.1.86 billion provisioned so far out of Rs.6.34 billion worth of investments made), investments in Zomato and Policybazaar have done really well. Info Edge first invested in Zomato in 2010. “Hitesh and I were using the app independently and got talking about how good it was. Hitesh told me we should consider investing in it and I immediately tracked Deepinder down and called him to our office and the rest, as they say, is history,” says Bikhchandani. Deepinder Goyal, founder and CEO of Zomato, who considers Bikhchandani to be his mentor, says Bikhchandani always has a different perspective to offer but also has the maturity to let the entrepreneur make the final decision. “They have been investors for almost eight years and have been very patient with us. They have great belief and faith in what Zomato can do in the longer term. Even during our bad times, they did not blink,” he says. One of the things he has imbibed from Info Edge is the focus on corporate governance: “There is no conflict of interest or grey areas and we are inspired by the standards they set for themselves and thus, we at Zomato also try adhere to the same standards.”

For the first four rounds of investment, Info Edge was the sole investor in the start-up. According to Thakkar, the company has invested around $25 million in Zomato where it continues to have 31% stake. Zomato was valued at $1.1 billion in its previous round where it raised $200 million from Ant Financial in February 2018, which included a secondary sale of $50 million. The secondary sale diluted Info Edge’s stake from nearly 45% to 31% and the company is content with the proceeds. “As the single largest shareholder, it is our responsibility to bring the best investors into our portfolio companies. If it means diluting our stake, we are more than happy to do it if it is the best interest of the company,” says Thakkar. News reports indicate that Zomato is now looking to raise another $400 million at a valuation of $2 billion following the recent fundraise of $210 million by Swiggy and the entry of Uber and Ola into the food delivery space.

Future blueprint

Post its recent investment in Policybazaar, the company still has about Rs.15 billion which can go towards funding growth initiatives of its internal businesses as well as those of investee companies. “Cash is central to our strategy. We use it to defend market share as well as go after new opportunities as the situation demands and our investments are structured in a way that they can be liquidated easily to raise additional funds, making us very agile in responding to competition,” says Thakkar.

Gupta of Helion Venture Partners says that apart from being very cash conscious, which helps them tide over the ups and downs of the economic cycle, it is the hunger to do more that keeps Info Edge going. “There is relentless focus on execution and despite the fair degree of success that they have enjoyed, they are still hungry. There is still a certain aggression with which they pursue every dollar of sale besides setting a very high standard of corporate governance,” he adds. Sustaining the growth momentum will ensure the business continues to generate more cash. “The company’s dominance in the recruitment business has enabled it to incubate capital intensive and untested businesses such as food delivery and online insurance aggregation. We expect the company’s recruitment business to fund existing businesses while allowing the company to afford the one-odd failure as it chases the next moonshot investment,” says Subburaman.

While some call Info Edge a company that functions like a PE fund, Bikhchandani is clear on where the company’s focus should be: “We are primarily an operating company. So our focus is going to be on the businesses we run. The surplus cash on our balance sheet allows us to invest. Naukri will be the foundation that all the businesses will be built on and we will continue to focus on cash profit.”