Moneycontrol Research

IndusInd Bank reported a steady quarter with most parameters on expected lines. The ad-hoc provision on IL&FS exposure marred the reported performance.

Source: Company

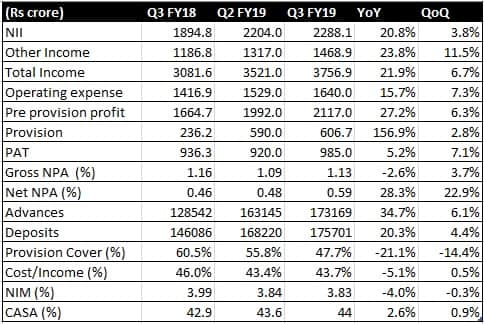

Net interest income (the difference between interest income and expenses) grew 21 percent aided by 35 percent growth in advances and a tad softening of interest margin to 3.83 percent. Interest margin was stable sequentially.

The non-interest income growth was supported by core fees that grew 18 percent and a sharp surge in treasury gains.

Operating expenses were well contained with the cost-to-income ratio stable at 43.7 percent. Consequently, pre-provision profit grew 27 percent.

The muted growth in reported profit at Rs 985 crore was on account of significant increase in the provisions as the bank made an ad hoc provision of Rs 255 crore for its exposure to the IL&FS group. Taking into account the provision made in Q2 (Rs 275 crore) and the floating provision, the total provision for this account stands at Rs 600 crore. However, the asset continues to be standard in the books of the bank. We await clarity on this account despite management assurance on an adequate provision.

Except for this account, the asset quality picture wasn’t worrisome, although provision cover appears to have fallen.

Business growth was healthy with advances growing 35 percent and deposits by 20 percent. However, the incremental credit-deposit ratio is still very high.

Overall other than the question mark on IL&FS exposure (which is partially addressed with the provision), the rest of the business has performed on expected lines.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!