Highlights

- Jewellery growth decent, thanks to the wedding season

- Softness seen in watches and eyewear

- Titan should end the year with a high single-digit top line growth

- Best placed consumer stock for the long term- Valuation demanding, accumulate on decline

First, the good news from Titan – The key segment, jewellery, that accounts for nearly 77 percent to sales and over 80 percent to operating profit registered a decent show in the December 2019 quarter, thanks to the traction because of the wedding season.

This came in the face of the general macroeconomic slowdown leading to poor consumer sentiment, along with disruptions caused by the anti–CAA (Citizenship Amendment Act) protests across the country.

The standout performance should probably help Titan end FY20 on a decent note of high single-digit top line growth.

Titan and the quarter gone by

The company witnessed varied consumer response in each of its divisions. Sales in all divisions in the second half of December also got impacted to some extent by forced store closures due to the protests.

Retail sales in jewellery were better than expected at the beginning of the quarter, possibly due to the wedding season and a reasonable inelasticity of wedding jewellery. The industry itself grew decently during the festive period. The company did better and market share gains were evident. The division met its revised expectations for the quarter under review. While revenue growth for quarter stood at 11 percent, that of retail was actually much better at 15 percent. During the base quarter, it had a large institutional order for gold coins of some Rs 200 crore.

Growth in Watches and Eyewear was difficult to come by. For watches, Q3 growth was flat and the market itself is estimated to have declined by around 4 percent due to poor customer sentiment. Eye Wear division’s revenue grew by only 2 percent, primarily led by heavy competitive activity.

Other Businesses of Fragrances continued to increase its distribution reach and witnessed growth in excess of 20 percent during the quarter.

Its subsidiary TEAL (Titan Engineering and Automation Limited) continued to grow at a very strong pace of 55 percent in Q3 on the back of strong order book and winning new orders from global clients.

CaratLane continued to record a strong growth -- around 65 percent -- in Q3 despite the softness in the market.

What pushed growth

In jewellery, the company launched Virasat collection in the plain gold category for the festive season of Diwali. Year to date, it has added 34 Tanishq stores and 8 Mia stores, with retail space addition being nearly 1,17,000 square feet. It plans to add 50 stores for the year to offset operational delays.

New launches continued in watches -- Titan Connected, Raga Facets, Titan Maritime were some of the new names. Fastrack brand launched Reflex Beat and All Nighters 2.0 collection Go Skate. Sonata rolled out its first hybrid collection Sonata Stride and Sonata Stride Pro as well as Sleek 3.0, Smart Plaid and Sonata Onyx. The division added close to 8,000 sq ft of retail space.

Its eyewear division added about 27,000 sq ft of retail space.

Perfumes were launched also under the Fastrack brand.

Taneira opened three stores during the quarter, one each in Mumbai, Bengaluru and the NCR (National Capital Region), taking the total store count for the business to 10 covering five cities. The brand unveiled in-house design collections called Courtyard Tales and Chokola during the period.

During October-December 2019, CaratLane came out with the Ombre collection, which was very well received. Eleven new stores were added in the quarter, taking the store count to 82.

What should you do with the stock?

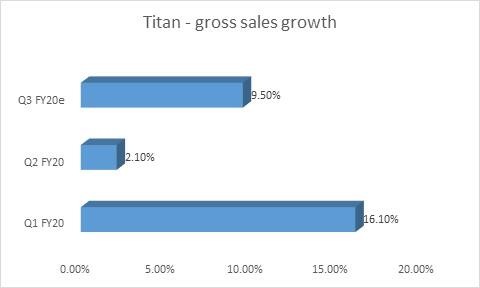

We expect Titan to clock close to double-digit gross sales growth in Q3 FY20 and end the year with a high single-digit top line growth.

Source: Company, Moneycontrol Research

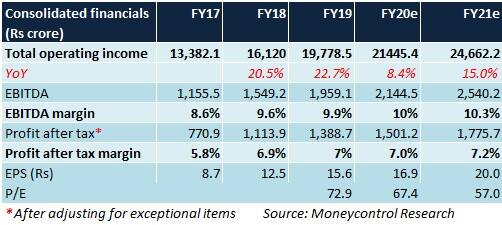

The stock has been a little subdued in the past six months on account of the downbeat consumer sentiment. Our view is, companies like Titan are best placed to capture the wallet share of growing, aspirational and affluent Indians and hence, an excellent bet for the long term. The valuation leaves us cold in the short term. We would use stock/market weakness for accumulating Titan for the long term.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!